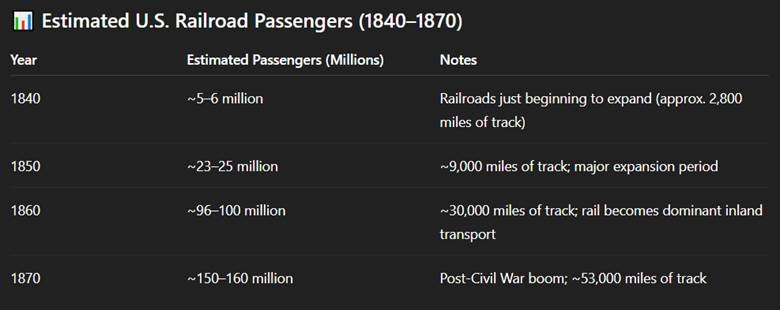

It took a while for the railroad industry to reach escape velocity from the naysayers and catch the attention of the big money.

It first caught on in New York City, but the Eerie Canal was still too important. Chicago was next, but the spaces between them were still slow to adopt.

It became a national initiative once moguls had convinced enough wagon riders to move themselves and their things with real speed.

A tale as old as time, and here you are thinking that the AI coin meta has come and gone?

Whatever your predisposition to the sector, I’m here to remind you that there is a whole world of finance and technology bustling outside of the crypto space that wants to get in. Interlopers breached the seals long ago and are shaping the inside. Allow me to explain how this is a good thing.

AI Meta Has Just Begun

It may seem like the AI meta has faded away like so many before it. Fads ranging from food coins to pepe coins to wif coins have all come and, for the most part, died off, with only a small handful of truly remarkable exemplars of the power of a motivated community maintaining a corner of the crypto mindshare that might always be delightfully weird.

Consider them the early train car types and rail widths.

After all, the total market cap of the AI coin sector has plummeted from winter ’24-’25 all-time highs.

During that time, adding ‘AI’ as a suffix to any meme ticker was a sure-fire way to send a coin to $1M market cap in a hurry in the trenches – or at least $500K. By that point, trench warriors had become accustomed to that attention cycle.

They may not be technically proficient, although many are – and they may not be visionaries, although many manifest their dreams of greater wealth – but people on the retail trading side of the Web3 AI meta have built up critical market demand for products. Those products, of course, being platforms and coins – ultimately use cases for the AI they have shined attention on.

This is the side of the AI meta that we all can see in the charts and social streams as it’s all above ground and in the light of day.

If anything, they built local connections among their own networks, but this isn’t scalable.

The Folly of Trench Warfare

Although above ground, the trenches tend to be murky. They can even be traumatic, but trench warriors are capricious, topblasting from one precarious peak to the next.

Some people really hate that about crypto traders. Aside from casual misogyny and the other merely to extract more value, shading the shame of a disappointed mother on an industry that has so much potential, they hate the low attention spans and sense of humor.

Luckily for us, AI coins on pump dot fun are no longer fun. The last one created was roughly 2 months prior to publication time.

I guess the joke’s on them because Nasdaq has already announced that it plans to support 24-hour stock trading by 2026. We’ll soon see about their precious attention spans. The concept has been proven, and the enterprises are pouncing on a new product market fit with capital.

Trenches Never Lead to Gold

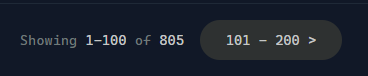

However, data would suggest that AI coins never escaped the mindshare. Or, maybe more accurately, the mindshare never fully rejected AI coins. Since my last check about a month prior, Virtuals has launched 64 new AI coins, bringing the total up to 805 as of June 17, 2025.

MAIAR hasn’t stopped shipping updates. In the several times I’ve spoken to the MAIAR team lead, he has never once brought up token price. Our conversations have only ever been focused on the capabilities of his work, as if there is a long-term vision unfolding before our dopamine-addled minds.

That is, frameworks on this network, launchpads on that network, and agents spread throughout the ecosystem have been creating a patchwork of Web3 AI use cases and applications. Reminiscent of how the transcontinental railroad was constructed in America.

Corporate investors have become simultaneously more sophisticated regarding their assessments of emerging technologies and more accepting of cryptocurrencies. This explains in some part why they’re emptying their pockets to get more TAO from Bittensor off the open market, and why Barry Silbert is leading the charge with his Digital Currency Group.

We should be able to conclude, based on the nascence of the sub-sector and the new capital flows, that the AI meta merely began in the winter and has hit its first trough.

Take the Space Between Us

The speed of financial growth in the east was remarkable, but bankers and industry moguls sought to expand their reach west, to gold. The main problem: the space between them.

I’m seeing the same pattern play out with Web3 AI.

Successful entrepreneurs in Web3 AI should be proud of themselves as their collective efforts caught the attention of the largest companies in the world. They all want to get in now that the concept has been proven so that they can lay some claim to the roads that lead them to more gold.

I can assure you that the likes of AWS, Alibaba Cloud, SoftBank, Google Cloud and others are interested in establishing and maintaining relationships with Web3 AI frameworks and launchpads. They clamor for them.

Among AI frameworks, Virtuals may now be at the top of their lists now that Eliza has imploded, but the work being done at Eliza can’t be discounted. Bittensor appears to be the darling among standalone protocols. None of the real tech being built is valueless.

Without going into too much detail about how the hyperscalers do business, rest assured that they establish relationships with the explicit end goal being an exchange of money for services.

Fill It with More Use Cases

The early use cases and applications of AI in Web3 have largely built upon the rails that the entire Web3 industry rides: immutable ledgers maintained by decentralized node operators, some offering privacy, most offering pseudonymity, and all offering something novel.

However, I’m finding that the scrappy cypherpunks and arrogant know-it-alls need more than they alone can provide now. For one thing, they need more capital. Another thing they need is people or organizations with experience in operational efficiency to pinpoint a need, build a solution, and sell it as a means of correcting an inefficiency that serves as a roadblock to the pile of gold on the other side.

Vaporware and mysterious, unprofessional carpetbaggers are not needed here as they’re just adding roadblocks – their proliferation is akin to manifesting more mountains on the way to the goal.

This is where we’re finding new abstract use cases of the critical stem cells of the AI industry within and outside of Web3: GPUs.

On the Dexscreener side of the world, everything is abstract. Pretty much everything is magical internet money and we’re just trying to wrap our heads around their invented use cases. That’s fine. That’s where initial demand for more power has come from in this case.

In the case of the physical world, GPUs are depreciating assets. Once you install them in your data center, they’re not likely to go anywhere. They do their job until they’ve reached their half-life or until they have become obsolete, then get chopped up and sold in parts.

Embrace InfraFi

Web3-minded people are now working to overcome that mountain, just as Bitcoin overcame gold, and how railroad builders blew through the mountains that stood in their way. They are more sophisticated than the ICO bros were, are far less esoteric than the DeFi summer prodigies were, and are (ostensibly) less extractive than the memecoiners are.

Look at GAIB, a startup that aims to tokenize GPUs, commoditize them, and provide a secondary market for the tokens. Co-Founder Kony Kwong is in tune with the future and developing use cases in the broader AI space, and has identified that commoditization is a path towards greater capital efficiency on the backend of the Web3 AI sector.

Bear in mind that GAIB hasn’t launched yet. It is still in a rather early stage, but reflects the light of the not-too-distant future wherein there are more ways to advance a tech sector and build wealth than with your BonkBot.

USD.ai

Recently, I spoke with the Co-Founder of USD.ai, Conor Moore, who, with his background in finance, is building a complex system of GPU tokenization verified by traditional methods. But that’s just the first step – the GPUs are tokenized and expected to be lent to USD.ai for stablecoins, namely USDT. Those stablecoins are traded in for USD.’s proprietary Liquid Colateral Token sUSDai.

The yield is based on the amortization of the tokenized GPU loans. Moreover, sUSDai, being traded on the secondary market, is subject to market pressures, which presents a significant challenge if institutions are expected to take the project seriously.

Even stETH had a scare a few years back when Curve pools became dangerously unbalanced.

sUSDai has been described more plainly as a yield-bearing stablecoin, but in Swept Podcast #10, Moore redefined it as a bond index token, which is likely a better nomenclature.

Like GAIB, USD.ai is still in beta, meaning that the teams expect to troubleshoot many issues.

However, importantly, USD.ai describes its place in the Web3 AI sector as fitting in InfraFi – infrastructure finance. In my opinion, this is a fitting category, a new one, that, in a phrase, succinctly places the tech in its rightful peg. I would put GAIB in this category, as I would the Cloud side of Aethir.

InfraFi is the financialization of Web3 AI infrastructure which, unironically, is the financialization of something else. And the money goes round. Believe me when I say that startups need that capital. Compounding it in any way possible is an invitation for the major enterprises to hop on and provide their ammo.

InfraFi projects are flattening the earth where the rails will go, and they’re building the train cars that we’ll all be riding west. Developer tools and data infrastructure providers like Pocket Network are building the rails. Blockchains are the stations – and tokens are the gas that makes it all move.

In short, the AI meta is being crafted at this intersection, and it merely needed some gas to get things started.

The Future State

At some point, likely within the next 18 months, builders on either end of the Web3 AI sector will bump heads and realize they’ve all been connected. The same thing happened with DeFi platforms as soon as AAVE perfected its protocol and Ethereum began to figure out scale with cheap gas.

Once that happens again, we will have opened access to a whole new frontier of technological proliferation and wealth generation.

The point being, it has happened before in fast motion in Web3, and I’m sure it will happen again, this time with AI coins and the foundational technology underlying them.

ReadyGamer CEO Talks AI Agents, Roblox Integration, And Web3 Monetization - SMW 2025 — Sweptpod

[…] refrAIn: The Real AI Meta […]